|

Whole

Life

Insurance

|

|

|

|

To understand the nature of whole life insurance (and the difference between whole life and term insurance), it is important to understand the concept of amount at risk. The amount at risk is the monetary value of the risk that the insured represents; it is the amount of money an insurer would have to pay to settle a claim.

A person represents a greater risk at an older age; this is reflected in a mortality charge that increases with age. With a term policy, the policy owner pays that increasingly higher mortality charge each year. The result is that term insurance rates increase each year.

|

|

|

|

A term policy does not accumulate a cash value. With a $100,000 term policy, the insurer's amount at risk is $100,000; which means that if the insured dies while the policy is in force, the insurer would have to pay $100,000. Each year, the insured grows older and draws closer to death. Thus, the mortality charge increases and will be reflected in the cost of the premium.

With permanent insurance, the net amount at risk decreases each year. The amount at risk with any whole life policy is the difference between the face amount of the policy and the cash value at any point in time.

|

|

|

|

The cash value represents a reserve fund or excess premiums paid in the policy's early years that are used to offset the need for greater premiums in later years. As the cash value increases, the insurer's amount at risk decreases. As the amount at risk decreases, the cost to the policy owner decreases. Conversely, the risk of death (and the mortality charge) increases with age. The net result is that the two counterbalance each other, resulting in a level premium. Insurers charge more than is required to cover the policy owner's mortality risk in the early years of the policy, and subsequently, charge less than the mortality risk would require in the insured's later years.

|

|

|

|

Cash value builds up in the early years of a policy to subsidize the cost of protection during the later years. There are no federal or state taxes imposed on the accumulation of cash value inside a life insurance policy. Whole life policies are structured so that the cash value gradually approaches the face amount until age 100, when the two are equal. At that point the insurer's amount at risk is $0, and the policy matures. Because the face amount and the cash value are equal, there is no longer any purpose for the insurer to hold onto the cash value, and the insurer will pay the insured the face amount of the policy.

|

|

|

|

**NOTE**

Whole life policies are required to start to accumulate a cash value no later than the end of the third policy year.

While there is no tax break for paying policy premiums, the cash accumulates and compounds tax deferred inside the policy.

********************************

|

|

|

|

An important feature of cash values is that the policy owner may access them via policy loan.

Insurers charge a nominal rate of interest on policy loans the maximum rate is regulated by state law. If an insured dies before the policy loan is paid off, the face value paid to the beneficiary is reduced by the amount of the loan and any accrued interest.

A policy loan is NOT a taxable event. If the owner withdraws the cash value, the withdrawl IS taxable.

|

|

|

5

|

|

|

|

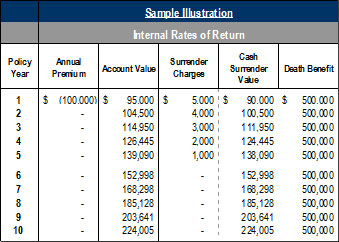

An illustration will show how the benefits that are not guaranteed will change as interest rates and other factors change, and what the insurer does guarantee. An illustration typically has two key components: Guaranteed illustration Current illustration The guaranteed illustration is the legally required disclosure of a worst-case scenario. It outlines policy performance based on the carrier’s minimum filed credit rates for a particular policy and the maximum mortality charges based on the 1980 commissioner’s standard mortality table. The current illustration is the insurer’s representations of policy performance based on rates and mortality charges currently in effect.

|

|

|

|

The illustration is an overview of the main elements of the policy and the opportunity to make sure the policy’s premium stream and benefits projections match the client’s needs and ability to pay. It shows a numeric summary of the illustration in 5 and 10-year increments.

The applicant signs a statement that he/she understands the nonguaranteed elements are subject to change.

The producer signs, saying he/she has explained the nonguaranteed elements are subject to change.

|

|

|

|

**NOTE**

The producer cannot highlight or otherwise mark an illustration. It is also unlawful for a producer to provide any illustration that is missing pages in the narrative summary.

******************************

|

|

|

|

The most common form of whole life insurance is the straight life policy with equal premium payments spread out for the life of the insured (or age 100).

Modified Life

This is a form of whole life insurance with lower premium requirements for a specified period of time, maybe five years, after which the premium increases for the remainder of the policy term. This is popular with people who have a smaller budget in their younger years.

|

|

|

|

Because early premiums are reduced, cash values accumulate slower than with a straight life policy.

Graded Premium Whole Life

This is a form of modified whole life, except that premiums increase steadily rather than in one single jump. Cash values accumulate very slowly because the premium in the early years can be as much as 50% less than that of a comparable straight life policy.

|

|

|

|

Limited Pay Whole Life With a limited pay whole life policy, the premium paying period is shorter than with a straight life policy, although coverage continues for the insured's entire life.

Premium payments are higher than with a straight life policy of comparable face amount. As a result, cash values accumulate faster than they do with a straight life policy.

While it is possible to pay up a policy with one premium payment, the most common forms of limited pay policies are the 20-pay life, where premiums are paid for 20 years, and LP65, with premiums paid to age 65.

|

|

|

|

**NOTE**

Limited pay and Single pay policies do not mature any earlier than do straight life policies. All whole life policies mature at age 100. The shorter the premium paying period, the higher the premium.

*******************************

|

|

|

|

While term and whole life insurance are the two basic forms of insurance, insurers have developed policies that combine features of both. Known as combination policies, they create a means of meeting very specific life insurance needs.

Economatic Whole Life

Economatic whole life is a whole life policy with a convertible term rider that uses dividends to convert the term to paid-up whole insurance over time.

|

|

|

|

Family Policy

The most common form of combination policypolicy is the family policy where a whole life policy is issued to the bread winner and level term policies are issued on the spouse and each child. As new children are born, they are automatically covered. A convertibility option is often added to each term policy to protect the children's future insurability.

|

|

|

|

The purpose of a family income policy is to guarantee that income will be provided to the surviving family members in the event of the bread winner’s premature death. It is a decreasing term policy attached as a rider to an underlying whole life policy, which will provide the funds needed to provide a predetermined income to the beneficiary for the remainder of a specified period of time.

For example, if Zack buys a 15-year family income policy and dies two years later, the monthly income benefit would be paid for the following 13 years; death 7 years after issuance would result in payments for the remaining 8 years; death at or after 15 years would produce no income benefit payments.

|

|

|

|

death at or after 15 years would produce no income benefit payments.

Family Maintenance

While similar to a family income policy, a family maintenance policy differs in that the monthly income is provided for a set period of time. It uses a level term policy rider added to the underlying whole life rather than a decreasing term rider. Using the previous example, the family maintenance policy would provide monthly income for 15 years, whether the bread winner died today, 5 years from now, or in 14 years.

|

|

|

|

**NOTE**

The typical structure of a family policy is:

Whole life insurance on the bread winner and level premium term riders on dependant spouse and children.

*********************************

|

|

|